how much state tax do you pay on a 457 withdrawal

In New York you can use your online services account or call 518 457-5434 to pay your tax bill. You will be taxed on a payment from the Plan if you do not roll it over.

Assuming youre not going to need 230000 per year to live off of in retirement pre-tax contributions may be more.

. Just like other retirement plans you do need to start taking distributions from your 457 plan by the age of 70 and a half years old. If you qualify and take the withdrawal during 2020 then the 10 penalty for early withdrawal will be waived. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made.

You also can be subject to a 10 early-withdrawal penalty on top of any income tax if you make a withdrawal before age 59 12. For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59 ½. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars. However if you do a rollover you will not have to pay tax until. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

If you do not believe that you had a filing requirement please check box B and provide an explanation along with documentation substantiating why you were not required to file with the State of Maryland eg copy of W-2 resident income tax return etc. If you make 30000 a year that might lead you to think that Roth is a good option but if your spouse makes 200000 a year your combined income on your joint tax return is 230000 which puts you in a higher tax bracket. Avoid a penalty by filing and paying your tax by the due date even if you cant pay what you owe.

Thrift savings plans TSPs are offered by the federal government and armed services. You will still owe income taxes on the withdrawal although you can spread out the taxes over three years. Click here for a 2021 Federal Tax Refund Estimator.

File online using one of our electronic filing options. The laws of the state in which you live do not usually matter for death tax purposes. Finally retirement contributions you make to an employer-sponsored retirement plan such as a 401k 403b or 457 are typically made on a pre-tax basis and therefore are excluded from your.

If you are under age 59½ and do not do a rollover you will also have to pay a 10 additional income tax on early di stributions generally distributions made before age 59½ unless an exception applies. Having withdrawal penalties before you reach a predetermined age. For example if you withdraw 12000 from your 401k you can choose to claim 4000 of income in 2020 2021 and 2022.

There is no penalty for an early withdrawal but be prepared to pay income tax on any money you withdraw from a 457 plan at any age. Youll pay income tax on withdrawals from a 457b plan but these plans arent subject to the early-withdrawal penalty so you wont be hit with that extra 10 fee. Youll pay 10 on the first 19900 of taxable income and 12.

Tax Forms and Rates What methods can be used to file an individual income tax return. You pay a tax on them during that tax year. For individuals and businesses.

457 plans may be offered by state or local governments as well as certain non-profit employers. So even if you live in a state without an inheritance tax you might be forced to pay one if you inherit assets from someone who lived in a state that does impose a death tax. Federal Income Tax Calculator 2021 federal income tax calculator.

In California you have a wide variety of. Apply online for a payment plan including installment agreement to pay off your balance over time.

What Are Defined Contribution Retirement Plans Tax Policy Center

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

State Of Louisiana Deferred Compensation Plan Irc Section 457 Plan New Egtrra Pension Legislation Flexibility Increased Savings Annual Dollar Deferral Ppt Download

Should You Pay Off Your Home With Retirement Funds Pros And Cons

What Is A 457 B Plan Forbes Advisor

Everything You Need To Know About A 457 Real World Made Easy

A Guide To 457 B Retirement Plans Smartasset

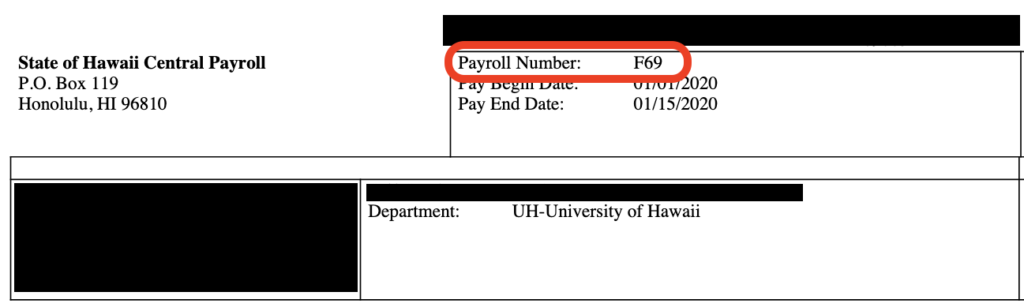

457 B Island Savings Plan Pre Tax Office Of Human Resources

A Guide To 457 B Retirement Plans Smartasset

How 403 B And 457 Plans Work Together David Waldrop Cfp